HNWI Guide to Aspen Real Estate as a Wealth Strategy

Investing in Second Homes for High Net Worth Individuals: A Lucrative Opportunity

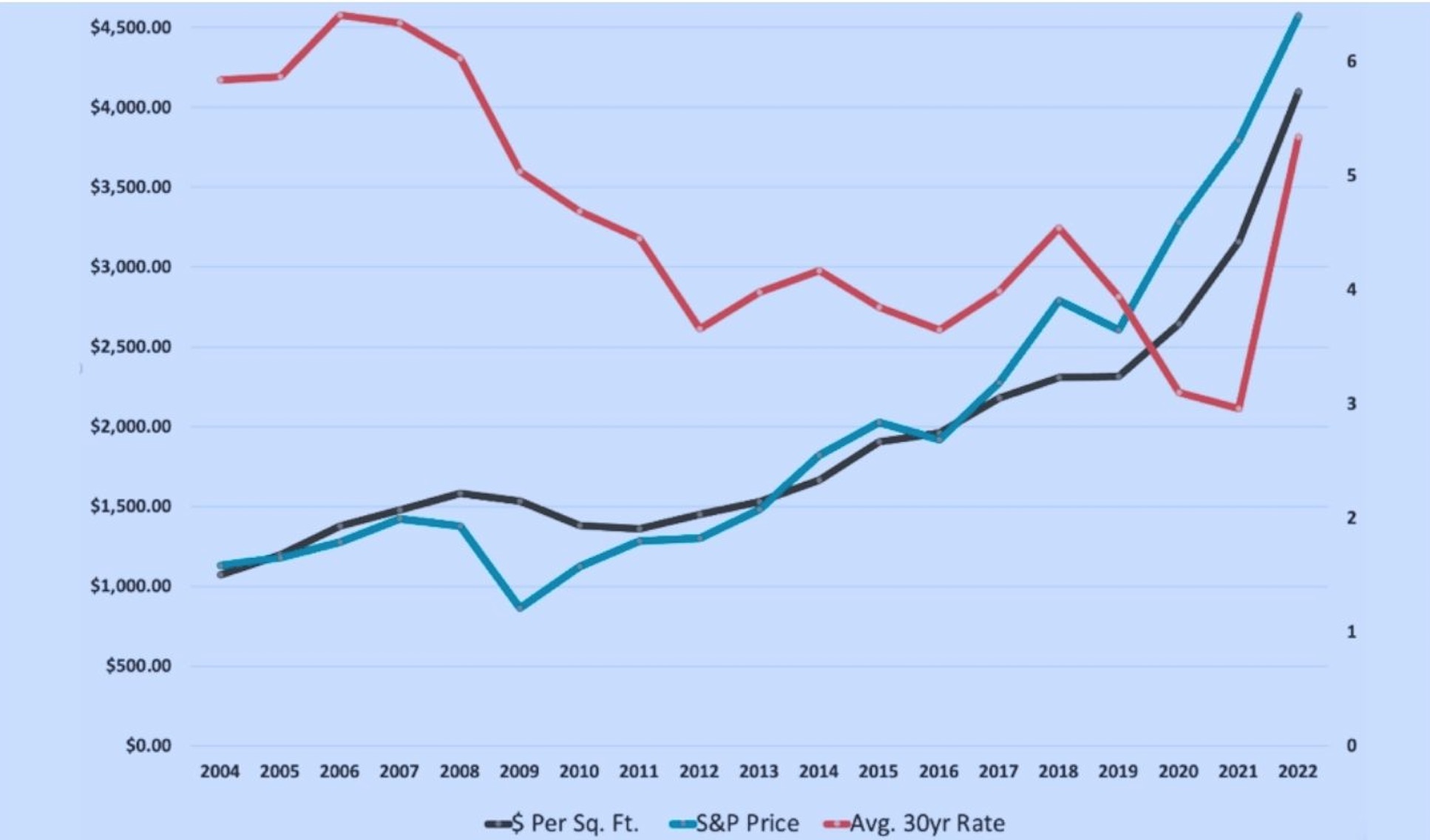

Welcome to the elite realm of Aspen real estate, where luxury meets legacy. For the discerning High Net Worth Individual (HNWI), Aspen is not just a destination but a strategic investment in enjoyment and enduring value. This blog is your guide to navigating the prestigious Aspen property market, where there is no mystery only history.- While the luxury Aspen market might not always outpace the S&P 500 during its peaks, it offers significantly lower downside risk.

- Noteworthy is the Aspen market’s resilience, maintaining its performance even amidst rising interest rates in 2005, 2006, 2013, 2014, 2017, 2018, and 2022.

- For 16 out of the past 19 years, the luxury Aspen market has witnessed consistent growth.

Diversification and Preservation of Wealth

One of the primary reasons HNWIs consider investing in second homes is to diversify their investment portfolio. While stocks, bonds, and other financial instruments may offer returns, they can also be volatile. Real estate, on the other hand, has historically proven to be a stable and appreciating asset class. By investing in second homes, HNWIs can hedge against market fluctuations and protect their wealth. Furthermore, second homes provide a tangible and enjoyable asset that can be used for personal vacations and family gatherings. These properties offer privacy, comfort, and the opportunity to create cherished memories. By investing in a location that appeals to personal interests, HNWIs can combine their passion for travel with the potential for financial gain.Rental Income and Capital Appreciation

Second homes have the potential to generate significant rental income, especially in desirable locations with a strong tourism industry. When HNWIs are not using the property, they can rent it out on platforms like Airbnb, VRBO, or through a property management company. This rental income can not only offset the costs associated with owning and maintaining the property but also provide a steady stream of passive income. Moreover, second homes in prime locations often experience substantial capital appreciation over time. Investing in areas with robust real estate markets and high demand can result in significant appreciation in property value. HNWIs can capitalize on this appreciation by selling the property at a later date, potentially yielding substantial profits.Tax Benefits and Asset Protection

Investing in second homes can offer several tax advantages for HNWIs. Interest payments on mortgage loans, property taxes, and maintenance expenses are often tax-deductible, reducing the overall tax burden. Additionally, if the property is held for a certain period, the gains from the sale may qualify for long-term capital gains tax rates, which are typically lower than ordinary income tax rates. Second homes can also provide asset protection for HNWIs. Owning property in different jurisdictions or countries can help safeguard wealth against potential political and economic risks. Furthermore, properties held under corporate structures or trusts can offer enhanced protection against legal liabilities.Considerations and Strategies for Maximizing Returns

While investing in second homes presents exciting opportunities, HNWIs should carefully consider several factors to maximize their returns:- Location: Choosing the right location is crucial. Opt for areas with strong rental demand, potential for capital appreciation, and attractive amenities such as beaches, ski resorts, or cultural attractions.

- Property Management: HNWIs should consider hiring a reputable property management company to handle the day-to-day operations, maintenance, and guest services. This ensures a hassle-free experience and maintains the property’s value.

- Financing: Evaluate different financing options to optimize returns. HNWIs can consider taking advantage of low-interest rates or exploring alternative financing methods such as private lending or leveraging existing assets.

- Market Research: Conduct thorough market research to understand supply and demand dynamics, rental rates, and property trends. This knowledge will help identify the most promising investment opportunities.

- Exit Strategy: HNWIs should develop a clear exit strategy, whether it involves selling the property at a specific time or passing it on as part of their estate

Tagged AspenHNWIReal EstateWealth